y291Εz

Market orientation and Company Performance:

A study of Selected Japanese and Sri Lankan Companies

Kajendra Kanagasabai

There have

been a few empirical studies on the relationship between market orientation and

business performance of companies in

Introduction

At present

all most all the companies, irrespective of developed or developing countries,

consider market orientation as a pivotal point in their decision making

process. Literature on this concept suggests that environmental factors such as

technology turbulence, competition, market turbulence, create the need of

market orientation (Malhotra, 2001). Therefore,

companies now adopt market orientation either as a culture or philosophy or

behavior (Kohli and Jaworski,

1990, Narver and Slater, 1990).

In relation

to defining market orientation, researchers have proposed varying definition of

market orientation in the literature. However, although the thinking of market

orientation occurred more than four decades ago, the importance of the concept

started from Kohili and Jawarski

(1990).

The strong

argument is that there is a relationship between market orientation and company

performance (Narver and Slater (1990), Ruekert (1992), Despande et al.

1993, Pelham and Wilson, 1996, Deng and Dart, 1994, Pelham and Wilson, 1996).

Although

there are several studies related to market orientation and its link with

company performance in many countries, very few studies conducted in

Defining Market Orientation

A number of

views of market orientation are apparent. In early 1990s Kohli

and Jaworski (1990) have offered a formal definition

of emarket orientation, as a set of behaviours

and activities in an organisation. Specifically the organisation-wide generation of market intelligence

pertaining to current and future customer needs, dissemination of the

intelligence across departments, and the organisation-wide

responsiveness y292Εzto

it. In other words, it is a process of generating and disseminating market

intelligence for the purpose of creating superior buyer value. Narver and Slater (1990) reinforce Kohli

and Jaworskifs (1990) conceptualisation by defining market orientation as gthe organisational culture that most effectively and

efficiently creates the necessary behaviours for the

creation of superior value for buyers and thus continuous superior performance

for the businessh. Based on this, they identified three behavioural components: customer orientation, competitor

orientation, and inter functional orientation.

According to

Slater and Narver (1995), market orientation provides

strong norms for learning from customers and competitors; it must be

complemented by entrepreneurship and appropriate organizational structures and

processes for high order learning. In general market orientation is concerned

with the processes and activities associated with creating and satisfying

customers by continually assessing their needs and wants (Uncles, 2000).

Market Orientation and Company Performance

Several

studies have been conducted to understand the market orientation and its impact

on company performance. Many of the empirical findings provide support for the

proposition that market orientation positively related to its company

performance (Table 1). Traditionally, company performance is measured by

business efficiency: it can be improved either by increasing the output for the

same input or by decreasing the input required to produce a given output.

However, in marketing for the purpose of performance or efficiency measures can

take different forms, such as objective measurement and subjective measurement.

The term gsubjectiveh is used to

mean that the companyfs performance score is derived using a scale with

anchors such as gvery poorh to gvery goodh, or gmuch lowerh to gmuch higherh as compared

to that of competitors. The term gobjectiveh measure is

based on the actual percentage figure for sales or profit or other financial

activities. One common feature of research into the effect of market

orientation on company performance is that studies generally incorporate

subjective measures of performance as the dependent variables. (Dawes, 1999)

Generally,

there is an impression that subjective measures are inappropriate. There are,

however, several good reasons for using them. The reasons in this regard are:

(1) managers may be reluctant to disclose actual performance data if they

consider it commercially sensitive or confidential, (2) subjective measures may

be more appropriate than objective measures for comparing profit performance in

cross-industry studies (Dawes, 1999). This is because profit levels can vary

considerably across industries, obscuring any relationship between the independent

variables and company performance. Subjective measures might be more

appropriate in this situation because managers can take the relative

performance of their industry into account when providing a response (i.e. rate

the profit performance of the company in relation to that of other companies);

(3) performance measures such as profitability may not accurately indicate the

underlying financial health of a company. Profitability may vary due to reasons

such as the level of investment in R&D or marketing activity that might

have long-term effects; and (4) there have been several studies that show a

strong correlation between objective and subjective measures (Dess and Robinson 1984). A number of previous studies have

found positive associations using subjective measures.

y293ΕzMost of the studies on market -orientation and organisational performance have incorporated objective

measures as well as subjective measures. Organisational

performance measures were assessed on sales growth, profitability, return on

investment/assets/, market share, profit, profitability, overall financial

performance, and product success.

The major

findings of selected studies on nature of the relationship between market

-orientation and company performance are summarised

in the Table 1.

y294Εz

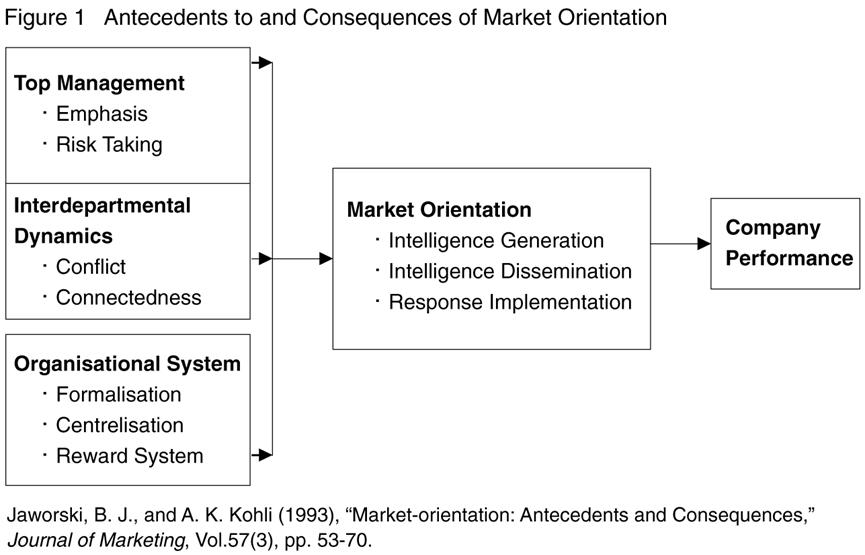

Antecedents to a Market Orientation

A market

orientation will not develop by itself. Literature identified several

antecedentsf factors to market orientation. It include top

management emphasis (Felton, 1959; Webster, 1988; Kohli

and Jaworski, 1990; Jaworski

and Kohli, 1993); top management risk taking (Despande and Webster, 1989; Kohli

and Jaworski, 1990; Jaworski

and Kohli, 1993); interdepartmental conflict (Dutton

and Walton, 1966; Kohli and Jaworski,

1990; Jaworski and Kohli,

1993); interdepartmental connectedness (Blake and Mouton, 1964; Lawrence and Lorsch, 1967; Despande and Zeltman, 1982; Kohli and Jaworski, 1990; Jaworski and Kohli, 1993); formalization, centralization, and Reward

system (Webster (1988); Sigauw, Brown and Widing (1994); Kohli and Jaworski, 1990; Jaworski and Kohli, 1993).

Conceptual Model

On the basis

of the operational definition of Kohili and Jaworski, (1990), the following determinant factors of

market orientation under the three components were considered: Intelligence

generation, Intelligence dissemination and Response Implementation.

y295Εz

Objectives and Hypotheses

Objectives of the Study

The broad

objective of this study is to evaluate the market oriented practices adopted by

Japanese and Sri Lankan companies and to examine the relationship between

market orientation and company performance.

The study has

the following specific objectives in terms of

@−To measure

the extent of market orientation;

@−To examine

the relationship between market orientation and company performance;

@−To measure

the impact of market orientation on company performance; and

@−To ascertain

the influence of antecedence factors on market orientation.

Hypotheses

On the basis

of the literature review on concept of market orientation, the following

hypotheses were developed.

Market Orientation and Company Performance

Several

empirical studies have found a strong positive relationship between market

orientation and performance (Diamantopoios and Hart,

1993; Greenly, 1995b; Narver and Slater, 1990; Jaworski and Kohli, 1993).

Therefore, the hypothesis that:

H1: The greater the market orientation

of a company, the higher its company performance.

Top Management Emphasis on

Market Orientation

The top

management must give clear signals and establish clear values and beliefs about

serving the customer. Market orientation is achievable only if the board of

directors and chief managers realize the need to develop positive attitude

towards market orientation. Continuous reinforcement by senior management y296Εzis required if individuals within the organizations

are to be encouraged to generate, disseminate and respond to market

intelligence (Levitt, 1969). Therefore the hypothesis

is that:

H2: The greater the top management

emphasis on market orientation, the greater the market orientation of the

company.

Top Management Risk Taking

Willingness

to take risks will encourage and facilitate organization wide commitment to

innovation and responsiveness (Kohli and Jaworski, 1990, Jaworski and Kohli, 1993). If top managers show a willingness to take

risks and accept failures as being natural, junior managers are more likely to

prepare and introduce offerings in response to market needs. Therefore, the

hypothesis is that:

H3: The greater the top management risk

taking, the greater the overall market orientation of the company.

Interdepartmental Connectedness

Connectedness

between departments facilitates interaction and the exchange of information (Ruekert & Walker, 1987). Interdepartmental

connectedness fosters interdependency within the company and encourages

employees to act in a concerted manner in the processes of knowledge generation

and knowledge utilization (Jaworski and Kohli, 1993). Therefore, the following is the formal

testable hypothesis:

H5: The greater the interdepartmental

connectedness, the greater the market orientation of the company.

Formalization

It is the

design parameter by which the work processes of an organization are

standardized. Formalization tends to hinder the generation and dissemination of

information and the response implementation (Jaworski

and Kohli, 1993).

Numerous

studies to argue that the formalization may have opposite effect on market

orientation (Zaltman et al., 1973; Despande & Zaltman, 1982).

Therefore, the hypothesis is developed as:

H6: The greater the formalization, the

lower the market orientation of the company.

Centralization

Centralization

represents a situation in which all the power for decision-making rests at a

single point within the organization. Numerous studies to argue that the

centralization may have opposite effect on market orientation (Zaltman et al., 1973; Despande

& Zaltman, 1982). Therefore, the expectation is

the following:

H7: The greater the centralization, the

lower the market orientation of the company.

Market Based Reward Systems

Rewards based

on customer satisfaction and service levels which encourage the active

generation and dissemination of market intelligence and responsiveness to

market needs. A basic requirement for the development of a market oriented firm

is the creation of market based measures of performance (Webster, y297Εz1988). Therefore, the hyphothesis

that:

H8: The greater the market based reward

system, the greater the market orientation of the company

Research Methodology

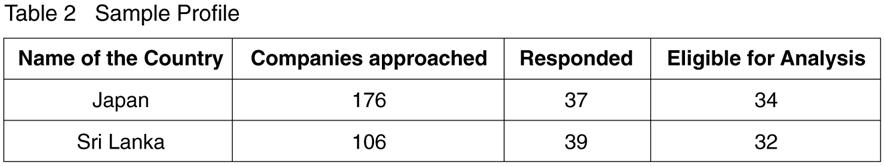

The Sample

The Hand Book

of Japanese and Sri Lankan Companies, published by stock exchange, were used to

draw sample for

Data Collection

The survey

method was adopted for the collection of data. The instrument used for the

purpose was a pre-tested structured questionnaire. Questionnaires were mailed

to the selected

The Questionnaire and Measures

To measure

the degree of market orientation, Kohli et al`s (1993) market orientation scale was adopted.

Specifically, a 34-item scale was used in this study, comprising four items

relating to intelligence generation, five items for information dissemination

and three items for response implementation. In addition to measuring the

extent of market orientation, the study also measured some of its antecedents,

using 22 items. Company performance was measured by using three subjective

measurement variables and one objective measurement variables. The respondents

were asked to indicate their level of agreement and disagreement with each

statement on a 5 point likert scale (1 strongly

disagree; 5 strongly agree).

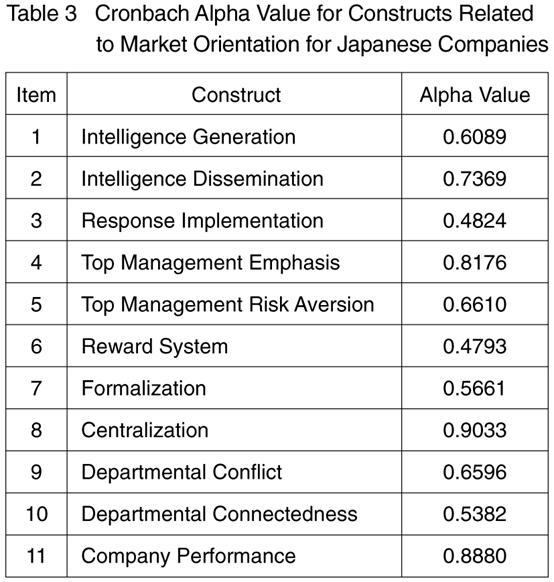

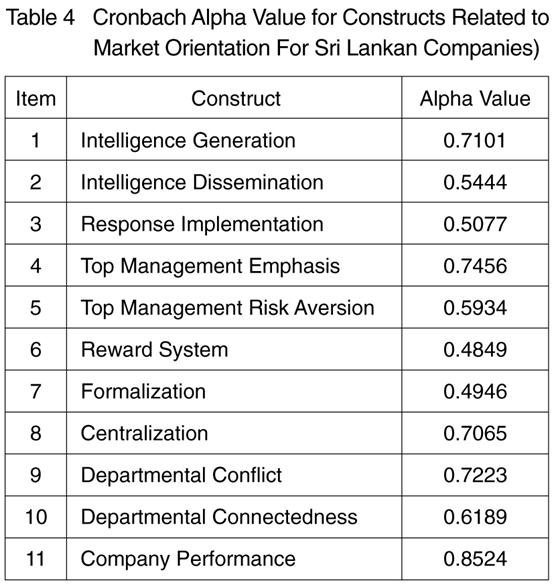

All the

statements, representing the market orientation and its major antecedents, were

tested for reliability by computing Cronbachfs alpha

values for both countries. (Table 3 and 4). The minimum value taken as

acceptable was 0.5 (Nunnally, 1967). As the

reliability coefficient values for the Japanese companies are well above the

acceptable value of 0.5, and the data can be taken as reliable and fit for the

further analysis. However, alpha values of reward system (0.4849), and

formalization (0.4946) are lower but very near to the acceptable value of 0.5.

The same situation occurred for Sri Lankan companies.

y298Εz

The extent of

market orientation was measured according to the methodology of Jaworski and Kohli (1993). Scores

of components of market orientation and other antecedentsf factors were

computed as simple arithmetic means of the corresponding items score.

Findings and Discussion

Market Orientation of Selected

Japanese Companies.

The extent of

market orientation was measured by summing the scaled value of responses to all

three-y299Εzcomponent

measurements: intelligence generation, intelligence dissemination, and response

implementation of the company.

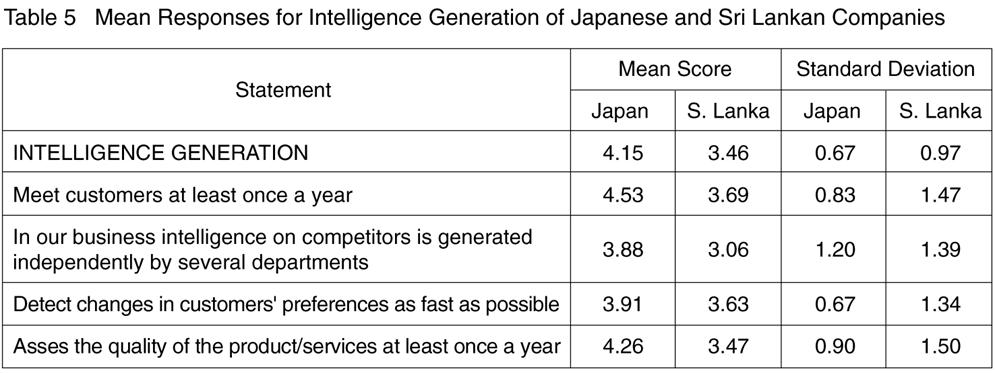

Intelligence

Generation

Japanese

companies in this sample think that collection of intelligence is very

important (Mean score- 4.26) and these company very much concern of meeting

their customers. Also, these companies highly concern of assessing quality of

the products/services (mean score- 4.26) and they put sincere effort to detect

the changes in customer preferences.

In case of Sri

Lankan companies, generation of intelligence by several departments and

assessing quality of the products/services seem to be poor (mean score, 3.06,

and 3.47 respectively). The overall mean score of intelligence generation

(3.46) fall in between 3 and 4 on a five point scale. It indicates that the Sri

Lankan companies do not put high effort to generate intelligence

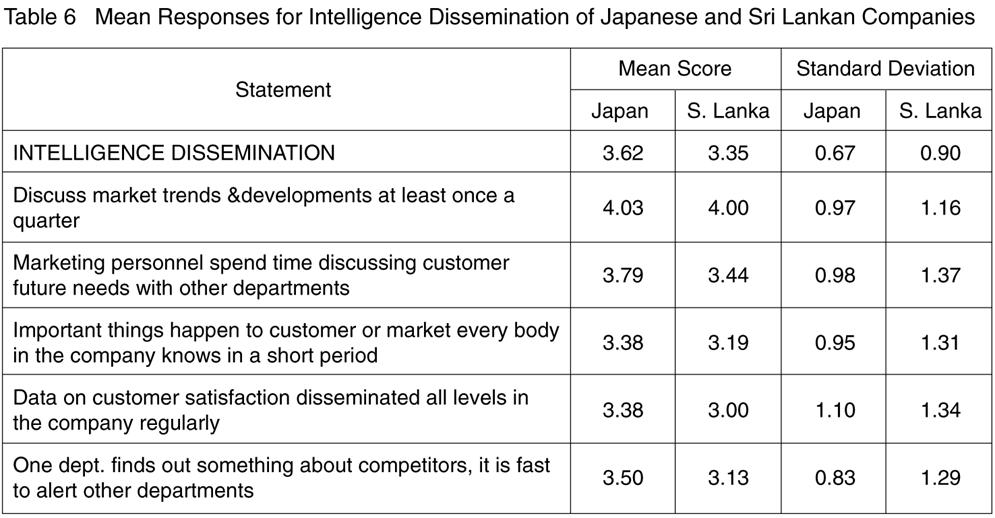

Intelligence Dissemination

Participation

of all departments is required for an effective response to market needs.

Intelligence must be communicated, disseminated and even sold to relevant

departments in the companies. The relatively high mean score (3.62) of

intelligence generation of Japanese

companies show that these companies gave due importance to the dissemination of

intelligence throughout the company. Particularly, these companies show their

interest on discussing market trends and development (mean, 4.03), and spending

time for discussing future needs with other departments (mean score, 3.79).

There was a positive perception that market information spread quickly through

all levels in the company.

The mean

score (3.35) of intelligence dissemination of Sri Lankan companies which is

just above the average mean, indicates that the respondent companies are not

much serious to disseminate the information throughout the company.

Particularly, these companies lack on disseminating data on customer

satisfaction (mean score, 3.00), slow to disseminate information on competitors

to other departments (3.13), and employees are slowly informed about market

changes (mean score, 3.19). But there was a high concern on discussing market

trends and developments (mean Score, 4.00).

y300Εz

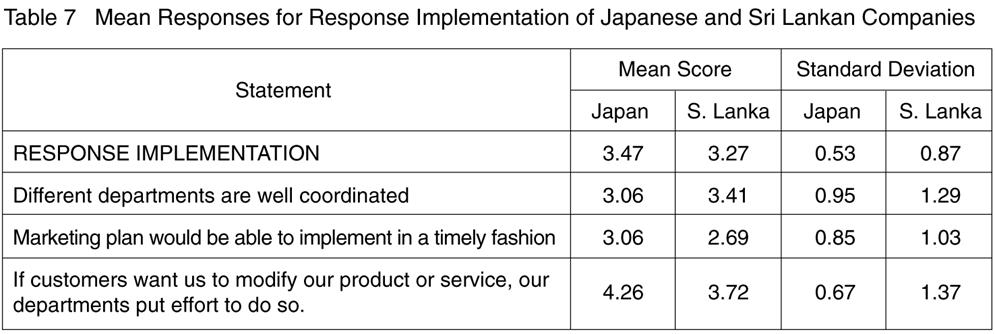

Response

Implementation

Responsiveness

is the action taken in response to intelligence that is generated and

disseminated. In fact all departments, not just marketing, participate in

responding to market trends in a market oriented company. The research findings

show that respondent companies were weaker on this front than with regard to

the generation and dissemination of intelligence. In relation to well

coordination of different departments (mean, 3.06) and implementing marketing

plan in a timely fashion (mean, 3.06) in these company point to a relatively

low degree of real responsiveness. However, the different departments in these

companies put more effort to modify their product or service (mean, 4.26).

The mean

score of response implementation (mean, 3.27) of Sri Lankan companies suggests

that the respondent companies were weaker in this aspect as generation and

dissemination of intelligence. Particularly, implementing marketing plan in a

timely fashion (mean, 2.69), and coordination of different departments (mean,

3.41) in these company are having low degree of real responsiveness.

The Adoption of Market Orientation

The mean

scores of market-orientation for the 34 sample companies from Japan and 32

companies y301Εzfrom

Sri Lanka were 3.74 with a standard deviation of 0.45 and 3.36 with a standard

deviation of 0.0.78 (on a 5- point scale) respectively. The extent of market

orientation of Japanese companies suggests that these companies had moved

towards market-orientation significantly. The Sri Lankan companies take middle

level in practicing market orientation on this front.

Market Orientation and Company Performance.

The

performance of the sample companies was measured using subjective and objective

approaches. The potential effects of market orientation on performance of

Japanese and Sri Lankan companies were investigated with multiple regression

analysis. Five performance measures such as overall performance of the company

(DV1), overall performance of the company relative to major competitors last

year (DV2), return on investment of the company relative to competitors last

year (DV3), sales of the company relative to competitors last year (DV4), and

return on asset (DV5) were used.

Table 8

contains the results of the correlation which indicate that market orientation

is significantly positively related to overall performance of the Japanese

company (r= 0.467, at 0.01 level). Other rest of the performance measures

including objective measures become no significance. Interestingly, for the Sri

Lankan companies, all the performance measures were significantly related to

market orientation. Based on this finding, it is accepted in both countries

that there is a positive significant relationship between market orientation

and overall company performance.

Results of

the multiple regression analysis are given in Table 9. These results show the

impact of market orientation on company performance. According to the outcome

of the regression model, only one variable (overall performance of the company)

was become significant to the Japanese companies but for

On the basis

of the results, 21.8% of the total variation (R2) in the Japanese

companiesf performance is explained by the market orientation.

In other words, 78.2% of the total variance in the company performance is

unexplained by the multiple regression equation. According to R value, the

percentage of association between dependent and independent variables are 46.7%

and it implies that market orientation directly associate with company

performance.

In relation

to Sri Lankan companies, the measurement of overall performance of the company

relative to major competitors last year, gives high value. Therefore, on the basis

of this result, 33.3% of the total y302Εzvariation (R2) in the company performance

is explained by the market orientation. In other words, 66.7% of the total

variance in the company performance is unexplained by the multiple regression

equation. According to R value, the percentage of association between dependent

and independent variables is 57.7% and it implies that market orientation

directly associate with company performance. It implies that market orientation

influence on company performance. Therefore, the hypothesis 1, that is egreater the

market orientation of a company, the higher its company performancef is accepted.

In relation

to Sri Lankan companies, the measurement of overall performance of the company

relative to major competitors last year, gives high value. Therefore, on the

basis of this result, 33.3% of the total variation (R2) in the

company performance is explained by the market orientation. In other words,

66.7% of the total variance in the company performance is unexplained by the

multiple regression equation. According to R value, the percentage of

association between dependent and independent variables is 57.7% and it implies

that market orientation directly associate with company performance. It implies

that market orientation influence on company performance. Therefore, the

hypothesis 1, that is egreater the market orientation of a company, the

higher its company performancef is accepted.

y303Εz

Antecedents Factors to Market Orientation

Table 10

indicates the mean score of antecedentsf factors

which support to market orientation. The mean scores both countries show that

all the factors of antecedents generally support to market orientation.

Specifically top managers in both countries were evidently fully devoted to

serving their customers in the most effective and efficient manner. Top

management risk taking in both countries is around the mid-point value of 3

which indicate that top management in both countries were preferred to follow a

middle path, neither taking big risks nor wanting to be left behind due to lack

of innovation. Also, the study reveals that the market-based reward system in

the both countries is not sufficiently exclusive and this will lead to a

reduction in the level of market orientation.

In relation

to formalization, the finding means score for both countries suggest that the

work processes and order of respondent companies are not strongly formalized.

This situation support market orientation in both nations. The nature of the

centralization of the Japanese companies implies that the respondents companyfs employees

were generally permitted to take decisions on their own even for small matters

and were encouraged. This is in fact likely to favor market orientation. The

mean value of Sri Lankan companies on this aspect indicate that the employees

were not given freedom very much to take decisions on their own. The extent of

inter-departmental conflict in both countries was less which encourages market

orientation. In the same manner, interdepartmental connectedness of the

companies in both countries was stronger. However, only the following factors

were found statistically significant difference between

The Strength and Impacts of

Antecedents on Market Orientation

The impact of

antecedentsf factors on market orientation is shown in Table 11.

On the basis of outcome of regression analysis, only two factors such as top

management emphasis and interdepartmental connectedness have been identified as

significant factors on market orientation of Japanese companies. y304ΕzThe rest of the factors are non significant in this

data set. On the investigation of the Sri Lankan companies, three factors such

as top management emphasis, interdepartmental connectedness and centralization

have been found as significant factors on market orientation.

The result

Japanese companies of regression analysis explain that 51.3% of the total

variation (R2) in market orientation is explained by the top management

emphasis, and departmental connectedness. In other words, 48.7% of the total

variance in the market orientation is unexplained by the multiple regression

equation and the percentage of association between dependent and independent

variables is 71.7 % (R value). It implies that these factors directly

associated with market orientation. Therefore, the two independent variables

that top management and departmental connectedness jointly affect the market

orientation. The conclusion in this regard that the Japanese companies should

be more concern of top management and departmental connectedness which is

fostering market orientation.

The

regression coefficients suggest that the top management emphasis,

centralization and departmental connectedness have the impact on market

orientation of Sri Lankan companies. The negative coefficient of centralization

suggests that there is a negative relationship between centralization and

market orientation that the higher the centralization of the company may leads

to the lower of the market orientation.

Based on the

above analysis, hypotheses 1 and 2 were accepted in both countries. In addition

to this, hypothesis 7 was accepted only by Sri Lankan companies. All other

hypotheses were rejected due to non significant.

Conclusion and Future for Further Research

The empirical

data on the market orientation and its organizational performance of Japanese

companies y305Εzsuggest

that these companies give high priority for market intelligence generation, to

meet customers, and to asses the quality of the products/services very often,

to emphasis the dissemination of Intelligence and having interaction of

marketing personnel with other departments to discuss the market trends and

developments. However, there are comparatively weaknesses in company

responsiveness, reluctant to take big financial risk by top management, and not

adapting market-based reward system.

Sri Lankan

companies do not put high effort to generate intelligence and not much serious

to disseminate the information throughout the company. Although top managers in

the respondent companies were relatively shown their intention to serving their

customers, the intention of risk taking is week and no encouragement for market

based reward system, employees were not given freedom to take own decisions. In

general, the responded Sri Lankan Companies give less priority to market

orientation.

Limitations and Direction for Further Research

There are

several other important factors may influence on market orientation such as environmental

factors and suppliers which are not considered in this study. Also our sample

size is relatively small.

It is more

appropriate, if the evaluation of market orientation would have come from both

company and customer point of view. We leave this for future investigation. The

role of market based reward system was not clear in promoting the market

orientation and calls for deeper insights through additional research in to the

linkage involved.

References

Au, A. K. M.,

and A. C. B. Tse (1995), gThe Effect of

Market-orientation on Company Performance in the Service Sector: A comparative

Study of the Hotel Industry in Hong Kong and New Zealand, h in J. Dawes

(1999), gThe Relationship Between Subjective and Objective

Company Performance Measures in Market-orientation Research: Further Empirical

Evidence, h Marketing Bulletin, Vol.10, pp. 65-75.

Avlonitis, G.J., and S. P. Gounariis

(1997), gMarketing-orientation and Company Performance:

Industrial vs. Consumer Goods Companies, h Industrial Marketing Management, Vol. 26, pp.385-402.

Balakrishnan, S. (1996), gBenefits of

Customer and Competitive Orientations in Industrial Marketsh, in J. Dawes

(1999), gThe Relationship Between Subjective and Objective

Company Performance Measures in Market-orientation Research: Further Empirical

Evidence, h Marketing Bulletin, Vol.10, pp.65-75.

Dawes, J.

(1999), gThe Relationship Between Subjective and Objective

Company Performance Measures in Market-orientation Research: Further Empirical

Evidence, h Marketing Bulletin, Vol.10, pp. 65-75 (Accessed through Internet).

Deng, S., and

J. Dart (1994), gMeasuring Market-orientation: A Multi Factor,

Multi-item Approach, h in J.Dawes (1999), g The

Relationship between Subjective and Objective Company Performance Measures in

Market-orientation Research: Further Empirical Evidence, h Marketing Bulletin, Vol.10, pp. 65-75.

y306Εz

Dess, G. G., and R. B. Robinson, Jr. (1984), gMeasuring Organisational Performance in the Absence of Objectives

Measures: The Case of the Privately- held Firms and Conglomerate Business Unit,

h Strategic

Management Journal, Vol.5 (July-September), pp.

265-273.

Deshpande, R., and F. E. Webster (1989), g Organisational Culture and Marketing: Defining the Research

Agenda, h Journal of

Marketing, Vol.53 (January), pp.3-15.

Deshpande, R., J. U. Farley, and F. E. Webster Jr. (1993), hCorporate

Culture, Customer-orientation and Innovativeness in Japanese firms: A Quadrad Analysis, h Journal of Marketing,

Vol.57 (January), pp. 23-27.

Deshpande, R., and J.U.Farley (1998),

gMeasuring Market-orientation: Generalization and

Synthesis, h Journal of Market

Focused Management, Vol. 2 (3), pp. 213-232.

Deshpande, R., and Z. Zaltman (1982),

g Factors Affecting the Use of Market Research

Information: A Path Analysish, Journal of Marketing Research, 19

(February), pp. 14-31.

Diamantopoulos,

A., and S. Hart (1993), gLinking Market-orientation Company

Performance: Preliminary Evidence on Kohli and Jaworskifs Frame Work, h Journal of Strategic Marketing, Vol.1, pp.93-121.

Esslemont, D., and T. Lewis (1991), gSome

Empirical Tests of the Marketing Concept, h in J. Dawes (1999),

gThe Relationship Between Subjective and Objective

Company Performance Measures in Market-orientation Research: Further Empirical

Evidence, h Marketing Bulletin, Vol.10, pp.65-75.

Felton, P. A.

(1959), gMaking the Marketing Concept Work, h Harvard Business Review, Vol. 37 (July-August), pp. 55-65.

Greenly, G.E.

(1995), gMarket-orientation and Company Performance: Empirical

Evidence from UK Companies, in J. Dawes (1999), gThe

Relationship between Subjective and Objective Company Performance Measures in

Market-orientation Research: Further Empirical Evidence, h Marketing Bulletin, Vol.10, pp. 65-75.

Han, J.K., N.Kim, and R.K. Srivastawa

(1998), hMarket-orientation and Organisational

Performance: Is Innovation a Missing, Link?, gJournal of Marketing,

Vol.62 (October), pp. 30.45.

Jaworski, B. J., and A. K. Kohli

(1993), gMarket-orientation: Antecedents and Consequences, h Journal of Marketing, Vol.57 (3), pp. 53-70.

y307ΕzKohli,

A. K., and B. J. Jaworski (1990), h

Market-orientation: The Construct Research Propositions, and Managerial

Implicationsh, Journal of

Marketing, Vol. 54, No. (2), pp. 01-18.

Levitt, T. (1960), gMarketing

Myopia, h Harvard Business

Review, Vol.38 (July-August), pp.45-56.

Lawrence,

P.R. and Lorsch, J.W. (1967), g Differenciation and Integration in complex Organisationsh,

Administrative Science Quarterly, Vol. 12, (June) pp. 1-47.

Malhotra, N.K. (2004), Marketing Research: An Applied

Orientation, 4th ed., Pearson Education, Inc.,

Narver, J. C., and S.F.Slater

(1990), gThe Effect of a Market-orientation on Business

Profitability, h Journal of

Marketing, Vol 57,

pp.20-35.

Nunnally, J. (1967), Psychometric Theory,

Pelham, A.M.,

and Wilson, D.T. (1996), gA Longitudinal Study of the Impact of Market

Structure, Firm Structure, Strategy, and Market-orientation Culture on

Dimensions of Small-firm Performance, h Journal of the Academy of marketing Science, Vol. 24, pp.27-443.

Pitt, L., A. Caruana, and P.R. Berthon (1996),

gMarket-orientation and Business Performance: Some

European Evidence, h International

Marketing Review, Vol.13, No.1, pp.5-18.

Ruekert, R.W (1992), g Developing a

Marketing-orientation: An Organisational Strategy

Perspective, h International

Journal of Marketing, Vol.9 (August), pp.225-245.

Ruekert, R. W., O.C. Walker, Jr. (1987), Marketingfs Interaction

with other Functional Units: A Conceptual Frame Work and Empirical Evidence, h Journal of Marketing, Vol. 51 (January), pp. 1-19.

Slater, S.F.,

and J. C.Narver (1994), gDoes

Competitive Environment Moderates the Market-orientation-performance

Relationship?h Journal of

Marketing, Vol. 58, No.1, pp.46-55.

Slater, S.

F., and J.C. Narver (1995), gMarket-orientation

and the Learning Organisation, Journal of Marketing, Vol. 59 (July), pp. 63-74.

Slater, S.F.,

and J.C. Narver (1996), gCompetitive

Strategy in the Market-focused Business, h in M. J.

Baker (edi.) (2001), Marketing: Critical Perspectives on Business and Management, (

Siguaw, J. A., G. Brown., and R. E. Widing

(1994), g The Influence of the Market-orientation of the y308ΕzFirm on Sales Force Behaviour

and Attitudes, h Journal of

Marketing Research, Vol. 31 (February), pp.106

-116.

Tse, A. C. B. (1998), Market-orientation and Performance

of Large Property Companies, in J. Dawes (1999), g The

Relationship Between Subjective and Objective Company Performance Measures in

Market-orientation Research: Further Empirical Evidence, h Marketing Bulletin, Vol.10, pp. 65-75.

Uncles, M

(2000), g Market Orientationh, Australian Journal of Management,

Vol.25, (September), pp.1-9.

Webster, F.E.

Jr., (1988), gRediscovering the Marketing Concept, h Vol.31

(May/June), pp.29-39.

Webster, F.E.

Jr., (1988), gRediscovering the Marketing Concept, h Vol.31

(May/June), pp.29-39.

Zeithaml, V. A., A. Parasuraman, and

L. L. Berry (1985), gProblems and Strategies in Service Marketing, h Journal of Marketing, Vol.49 (Spring), pp.33-46.

About

the Author

Dr. K. Kajendra

Senior

Lecturer, Faculty of Management and Finance

Coordinator,

MBA in Marketing Programe, Faculty of Management and

Finance,

kk4ssrr@hotmail.com

This research

is funded by Japan Foundation under the Japan Foundation Fellowship programe.