【325頁】

Licensing

of a lower-cost production process to an asymmetric Cournot duopoly

Dimitry

Rtischev1

Abstract

An outside inventor of a new production process seeks

to license it to Cournot duopolists which have unequal ex ante costs. Distinguishing “leading-edge” innovations

(new cost below both firms’ costs) from “catch-up” innovations

(new cost between the two firms’ costs), we

compare the equilibria of two license-selling mechanisms: exclusive license

auction and non-exclusive price-setting.

In contrast to the often-studied case of an innovation that reduces the

cost of any licensee by the same amount, we show that licensing of a new

process may attenuate the ex ante cost asymmetry, allow the inefficient firm to

leapfrog its competitor, and raise the licensee’s net

profits.

1. Introduction

The modern theory of licensing of a cost-reducing

innovation uses game-theoretic models to analyze the interaction among an

inventor and potential licensees who compete in a downstream market. The externalities that the innovation

generates among the downstream competitors makes the upstream trade in

technology a much more complex and subtle affair than trade in a typical market

for procuring inputs. After more

than twenty years of increasingly elaborate models, the theory has examined and

clarified many issues that influence the structure, pricing, and allocation of

licenses, including royalties vs. fixed-fees, auctions vs. price-setting,

inside or outside inventors, and exclusivity. However, the conception of what

constitutes “a cost-reducing innovation” remains elementary. Specifically, most licensing theory

developed so far has focused on identical firms and assumed that a given

cost-reducing technology can bring down unit cost by the same amount at any

firm that licenses it. One goal of

this paper is to propose alternative conceptions of a cost-reducing innovation

that may plausibly arise in a manufacturing industry and engender distinct

strategic consequences. A second

goal is to explore one of those alternatives in detail and compare the results

with previous findings. A third

goal is to demonstrate that doing away with the usual assumption that firms are

identical leads to substantively richer as well as more realistic models of

technology licensing.

We begin in the next section by attempting to ground

the conception of a cost-reducing innovation in specific conditions that may

arise in a typical manufacturing industry, without assuming that firms have

identical costs. This leads us to

interpret the prevalent conception of a cost-reducing innovation as an

innovation 【326頁】that eliminates one step in the production process,

and to identify other plausible kinds of cost-reducing innovations. Focusing on an innovation which

constitutes an entirely new way of producing the downstream good, we proceed to

specify a duopoly model in Section 3 and use it to analyze the sale of a

new-process license via an auction (Section 4) and via price-setting (Section

5). In contrast to step-eliminating

innovations, we show that licensing of a new process can attenuate the ex ante

cost asymmetry and allow the inefficient firm to leapfrog its competitor. We also show that an exclusive-license

auction does not necessarily earn the inventor more revenue than non-exclusive

price-setting.

2. Alternative conceptions of a

cost-reducing innovation

A very general conception of licensing has been put

forth in Katz and Shapiro’s seminal

paper “How to license intellectual property” (1986).

Although they conduct much of their discussion in the specific context

of an inventor licensing an innovation to an oligopoly, they stress that their

model applies to the licensing of any “intangible

property” (IP) that satisfies the following conditions

1. there is only one licensor, and it has access to an

infinite supply of the IP at zero marginal cost (i.e., development costs have been sunk)

2. there are several identical potential licensees,

each of which has use for at most one unit of the IP

3. the profit of the licensee (gross of the license

fee) is higher than the profit of a non-licensee

4. the profit of a non-licensee decreases as more of

its competitors acquire licenses (i.e. ,

by becoming a licensee, a firm imposes a negative externality on a

non-licensee)

Katz and Shapiro stress than these assumptions

describe not only the case of licensing of a cost-reducing technology but also

the licensing of an industry standard or the sale of access to some central

facility. Notably, the authors

abstain from specifying a model of how potential licensees compete in the

downstream market and how obtaining access to the IP affects a firm’s competitive standing. Remaining at a high level of

abstraction, Katz and Shapiro (1986) and Shapiro (1985) derive interesting

general results including:

(i) an inventor obtains more licensing revenue via

auctioning off a limited number of licenses than by setting a price and letting

any interested firm buy, and

(ii) licensing that maximizes inventor’s revenue leaves both licensees and non-licensees with

less net profit than ex ante (i.e.,

the inventor appropriates some of the licensee’s ex ante

profit).

These results have been confirmed and elaborated in

the context of specific models of competition among potential licensees in a

downstream market. Following the

seminal papers of Kamien and Tauman (1984, 1986), most models assume identical

firms with constant marginal cost c>0

engaged in Cournot competition in a market with linear demand. (Kamien, 1992;

Wang, 1998; Sen and Tauman, 2007)

The innovation is defined as a reduction in cost from c to ![]() , assuming

, assuming ![]() . All

firms are assumed identical ex ante and it is also assumed that any firm can

realize the same amount of cost-reduction

. All

firms are assumed identical ex ante and it is also assumed that any firm can

realize the same amount of cost-reduction ![]() if it puts

the innovation to use.

if it puts

the innovation to use.

The case of ex ante cost asymmetries has been largely

ignored. Although the asymmetric

case is much less tractable, there are at least three important reasons why it

deserves attention. First, perfect

cost symmetry is unlikely in any real industry. Second, the assumption of perfect cost

symmetry leads 【327頁】to auction equilibria in which potential

licensees make identical bids, which then requires a random draw to allocate

the license. Some properties of

such equilibria may arise from the tie-breaking rather than from substantive

aspects of downstream competition.

In particular, as our analysis will show, findings (i) and (ii) above

may be violated when firms are not identical. Thirdly, including ex ante cost

asymmetries in a model forces us to clarify the conception of a cost-reducing

innovation by identifying and distinguishing specific ways in which a new

technology may reduce production costs.

This is so because, if firms are not identical in terms of their ex ante

costs, it is likely that they may also differ in the extent to which the

innovation can reduce their costs.

We propose that the following three types of

cost-reducing innovation may plausibly arise in a manufacturing industry and

engender distinct strategic consequences for the allocation and pricing of

licenses.

Step-eliminating innovation.

Ex ante, the unit production cost is ![]() for firm i.

The production processes used by the firms may differ, but each process

includes a step that is common to all firms. The cost of this common step is

for firm i.

The production processes used by the firms may differ, but each process

includes a step that is common to all firms. The cost of this common step is ![]() per

unit. The innovation eliminates

this step, thereby reducing the production cost of a licensee to v. This type of innovation is

congruent to the innovation assumed in most models of the strategic licensing

literature cited above.

per

unit. The innovation eliminates

this step, thereby reducing the production cost of a licensee to v. This type of innovation is

congruent to the innovation assumed in most models of the strategic licensing

literature cited above.

New process innovation.

Ex ante, the unit production cost is ![]() for firm i.

The innovation is a whole new process to produce the same output good at

a per-unit cost

for firm i.

The innovation is a whole new process to produce the same output good at

a per-unit cost ![]() . To use

the innovation, a licensee must abandon its previous process and replace it

with the new process. We will take

up this case in detail in the following sections and show that licensing of a

new process innovation is substantively different from licensing a

step-eliminating innovation.

. To use

the innovation, a licensee must abandon its previous process and replace it

with the new process. We will take

up this case in detail in the following sections and show that licensing of a

new process innovation is substantively different from licensing a

step-eliminating innovation.

General cost-reducing

innovation. Ex ante, the unit production cost is ![]() for firm i.

By adopting the innovation, firm i

can achieve a unit cost

for firm i.

By adopting the innovation, firm i

can achieve a unit cost ![]() . Such

firm-specific cost-reductions may arise if a particular input (e.g., electricity) is used by firms in

different amounts and the innovation reduces the cost of procuring that input (e.g., new electricity generator). Since cost-reductions are firm-specific,

the gains to becoming a licensee and the losses from not becoming a licensee

are also firm-specific. An auction

to allocate a limited number of licenses to such an innovation is a special

case of an auction with identity-dependent externalities, a difficult problem

that has received some attention from auction theorists. (see Aseff and Chade, 2008; Das Varma,

2002; Funk, 1996) Applying the

theory of auctions with interdependent valuations to the specific case of

licensing appears to be a promising new direction.

. Such

firm-specific cost-reductions may arise if a particular input (e.g., electricity) is used by firms in

different amounts and the innovation reduces the cost of procuring that input (e.g., new electricity generator). Since cost-reductions are firm-specific,

the gains to becoming a licensee and the losses from not becoming a licensee

are also firm-specific. An auction

to allocate a limited number of licenses to such an innovation is a special

case of an auction with identity-dependent externalities, a difficult problem

that has received some attention from auction theorists. (see Aseff and Chade, 2008; Das Varma,

2002; Funk, 1996) Applying the

theory of auctions with interdependent valuations to the specific case of

licensing appears to be a promising new direction.

In the remainder of the paper we analyze the licensing

of a new process innovation and compare the results to the case of a

step-eliminating innovation.

3. Model

A Cournot duopoly producing undifferentiated goods

faces inverse demand given by ![]() , where qi is the quantity produced by firm

, where qi is the quantity produced by firm ![]() , a>0 is a demand

parameter, and p is the market-clearing

price. We assume that firms have

positive costs and that firm 1 is more efficient.2

To 【328頁】focus attention on non-drastic innovations,

we further assume that the inefficient firm would produce a positive amount

even if the efficient firm were to succeed in reducing its unit cost to

zero. The following condition

incorporates these assumptions about costs:

, a>0 is a demand

parameter, and p is the market-clearing

price. We assume that firms have

positive costs and that firm 1 is more efficient.2

To 【328頁】focus attention on non-drastic innovations,

we further assume that the inefficient firm would produce a positive amount

even if the efficient firm were to succeed in reducing its unit cost to

zero. The following condition

incorporates these assumptions about costs:

(1)

(1)

We will use the following notation to denote the

Cournot equilibrium profit of firm i

as a function of its and rival’s unit costs:

where ![]() and

and ![]() . Ex-ante

profits of the duopolists will be denoted by

. Ex-ante

profits of the duopolists will be denoted by ![]() and the ex

ante cost difference by

and the ex

ante cost difference by ![]() .

.

An independent inventor patents a new production

process that can be used to produce the same goods more efficiently than the

inefficient firm. Specifically, the

new process has a unit cost e

< c2. We

distinguish innovations that are a breakthrough for the industry from

innovations that can help the inefficient firm catch up, as follows.

Definition.

A leading-edge innovation is a

new production process with unit cost e

that satisfies ![]() .

.

Definition.

A catch-up innovation is a new

production process with unit cost e

that satisfies ![]() .

.

As the following analysis will show, the strategic

consequences of licensing leading-edge and catch-up innovations are quite

distinct.

4. Exclusive licensing via

auction

The inventor may choose to hold an auction to allocate

an exclusive zero-royalty license to the innovation.3 Each firm’s bid in the

auction represents a per-period fixed fee the firm is willing to pay to become

the exclusive licensee. The auction

is conducted as a sealed-bid second-price auction. Let Wi represent the profit of firm i if it wins at auction, gross of the

license fee it will have to pay.

Let Li represent

the profit of firm i if it loses the

auction. Since the auction is

second-price, it is optimal for each firm to enter a bid equal to its

willingness-to-pay. The firms thus

bid ![]() , the highest bidder becomes the licensee, and

thereafter pays a license fee

, the highest bidder becomes the licensee, and

thereafter pays a license fee ![]() per

period. We can decompose the

willingness to pay for the license into “use value” and “loss-prevention

value.”

The use value of the license to firm i

is

per

period. We can decompose the

willingness to pay for the license into “use value” and “loss-prevention

value.”

The use value of the license to firm i

is ![]() , since this is how much it can gain from using the

new technology. The loss-【329頁】prevention value

is

, since this is how much it can gain from using the

new technology. The loss-【329頁】prevention value

is ![]() , which represents the loss a firm will suffer if its

rival gets the license.

, which represents the loss a firm will suffer if its

rival gets the license.

4. 1 Exclusive licensing of a catch-up

innovation

The efficient firm has zero use value for a catch-up

innovation, since if it obtains the license, it would be most profitable to

shelve the new technology and keep producing with the old process. However, the efficient firm has

loss-prevention value for a catch-up innovation, because by obtaining a license

it can prevent its rival from becoming more efficient. Specifically, the gross payoffs to the

efficient firm from winning or losing the auction are:

The inefficient firm has zero loss-prevention value

but positive use value for a catch-up innovation, since the inefficient firm

loses nothing if the efficient firm licenses the innovation and then shelves

it. Specifically, after the auction

the inefficient firm stands to earn one of the following gross profit levels:

In the auction, the firms bid ![]() .

Regardless of which firm wins the license, the inefficient firm will not

suffer a loss in net profit but the efficient firm will. The next proposition makes this precise.

.

Regardless of which firm wins the license, the inefficient firm will not

suffer a loss in net profit but the efficient firm will. The next proposition makes this precise.

Proposition 1. Allocation of an exclusive license to a

catch-up innovation via an auction weakly increases the net profit of the

inefficient firm and strictly decreases the net profit of the efficient firm.

Proof.

The inefficient firm can retain its ex ante profit by bidding zero in

the auction, letting the efficient firm win the license and shelve the new

process. Thus, if the inefficient

firm chooses to make a positive bid, it must be for the purpose of obtaining a

higher net profit in the case of winning the auction. If the efficient firm wins the license,

it shelves the technology. Its

profit from production remains unchanged but net profit falls by the amount of

the license fee. ■

Which firm wins the license leads to different

consequences not only for the firms’ profits but

also for consumer surplus and the source of inventor’s compensation.

If the inefficient firm gets the license, the inventor appropriates part

of the new profit the innovation brings to the licensee, but not any of its ex

ante profit. The lower cost enjoyed

by the licensee will lead to more output, lower price, greater consumer

surplus, higher net profit for the inefficient firm, but lower profit for the

efficient firm. Thus, by licensing

a catch-up innovation to the inefficient firm, the inventor ends up hurting the

efficient firm indirectly, via competition in the output market, and ends up

helping its direct client - the licensee - as well as downstream

consumers. However, if the

efficient firm wins the license, there will be no change in 【330頁】quantities,

prices, consumer surplus, or the inefficient firm’s

profit. The inventor will have

simply appropriated part of its client’s ex ante

profit − a pure transfer of an incumbent’s rent with no efficiency consequences.

Which firm will win the license to a catch-up

innovation depends on the ex ante cost asymmetry and the size of the

innovation. The next three

propositions specify the relevant conditions.

Proposition 2.

If the ex ante cost asymmetry is larger than ![]() then any catch-up

innovation will be licensed by the inefficient firm.

then any catch-up

innovation will be licensed by the inefficient firm.

Proposition 3. If the ex ante cost asymmetry is smaller

than ![]() then any

catch-up innovation will be licensed by the efficient firm.

then any

catch-up innovation will be licensed by the efficient firm.

Proposition 4. If the ex ante cost asymmetry falls in

the range ![]() then there

exists a critical size of a catch-up innovation

then there

exists a critical size of a catch-up innovation ![]() such that

any more significant catch-up innovation

such that

any more significant catch-up innovation ![]() will be

licensed by the inefficient firm and any less significant catch-up innovation

will be

licensed by the inefficient firm and any less significant catch-up innovation ![]() will be

licensed by the efficient firm. The

critical size of a catch-up innovation is

will be

licensed by the efficient firm. The

critical size of a catch-up innovation is ![]() . The

bigger (smaller) the ex ante cost asymmetry, the broader (narrower) the range

of catch-up innovations licensed by the efficient firm.

. The

bigger (smaller) the ex ante cost asymmetry, the broader (narrower) the range

of catch-up innovations licensed by the efficient firm.

Proof. The bids of the efficient and

inefficient firms for an exclusive license to a catch-up innovation are,

respectively, ![]() and

and ![]() . From

this it follows that

. From

this it follows that ![]() if and

only if

if and

only if ![]() . Imposing

the restrictions

. Imposing

the restrictions ![]() and

and ![]() , and using the definition of ex ante cost asymmetry

, and using the definition of ex ante cost asymmetry ![]() leads to

Propositions 2 through 4. ■

leads to

Propositions 2 through 4. ■

The overall picture that emerges from these results is

that a catch-up innovation will end up being put to use by the inefficient firm

only when the ex ante cost asymmetry is large enough and if the innovation

promises a large enough cost reduction.

Thus, only significant catch-up innovations in significantly asymmetric

duopolies can be expected to end up in the hands of the inefficient firm and

thereby reduce the cost asymmetry and increase consumer surplus. Conversely, a sufficiently small ex ante

cost asymmetry will be perpetuated in spite of any catch-up innovations offered

for licensing by outside inventors.

Such inventions will be kept out of use by preemptive licensing by the

efficient firm. This implies that

it is possible for a slightly more efficient firm to be driven to progressively

lower profit levels by a series of outside inventors auctioning off catch-up

innovations. Considered in

isolation, each such auction for a catch-up innovation makes it rational for

the efficient firm to outbid the inefficient firm and then shelve the

innovation. However, by

accumulating such licenses the efficient firm will progressively pay out more

of its gross profit to the inventors, eventually ending up with zero net

profit.4 We caution that the rationality of such

preemptive licensing may be questioned in a model that allows firms to

anticipate 【331頁】future innovations.

4.2 Exclusive licensing of a leading-edge

innovation

A leading-edge innovation has both use value and

loss-prevention value for both firms.

Specifically, the gross payoffs to firm i from winning or losing the auction, respectively, are:

For each firm, winning a license auction increases

gross profit ![]() whereas

losing decreases it (

whereas

losing decreases it (![]() ).

This win-or-lose situation is structurally similar to the case of a

step-eliminating innovation that is the focus of most strategic licensing

models cited earlier. However,

because the licensing of a new process to an asymmetric duopoly engenders

different amounts of cost-savings for the two firms, there are equilibria

different from those identified in the literature on step-eliminating

innovations. Specifically, whereas

in the case of a step-eliminating innovation the efficient firm always outbids

the inefficient firm and thereby increases the cost asymmetry via licensing,

the opposite outcome is possible in the case of a leading-edge new process

innovation. The next three

propositions make this precise.

).

This win-or-lose situation is structurally similar to the case of a

step-eliminating innovation that is the focus of most strategic licensing

models cited earlier. However,

because the licensing of a new process to an asymmetric duopoly engenders

different amounts of cost-savings for the two firms, there are equilibria

different from those identified in the literature on step-eliminating

innovations. Specifically, whereas

in the case of a step-eliminating innovation the efficient firm always outbids

the inefficient firm and thereby increases the cost asymmetry via licensing,

the opposite outcome is possible in the case of a leading-edge new process

innovation. The next three

propositions make this precise.

Proposition 5. If the ex ante cost asymmetry is larger

than ![]() then any

leading-edge innovation will be licensed by the efficient firm.

then any

leading-edge innovation will be licensed by the efficient firm.

Proposition 6.

If the ex ante cost asymmetry is smaller than ![]() then any

leading-edge innovation will be licensed by the inefficient firm.

then any

leading-edge innovation will be licensed by the inefficient firm.

Proposition 7. If the ex ante cost asymmetry falls in

the range ![]() then there

exists a critical size of a leading-edge innovation

then there

exists a critical size of a leading-edge innovation ![]() such that

any more significant innovation

such that

any more significant innovation ![]() will be

licensed by the efficient firm and any less significant leading-edge innovation

will be

licensed by the efficient firm and any less significant leading-edge innovation

![]() will be

licensed by the inefficient firm.

The critical size of a leading-edge innovation is

will be

licensed by the inefficient firm.

The critical size of a leading-edge innovation is ![]() . The

bigger the sum of the ex ante costs, the larger the range of leading-edge

innovations licensed by the efficient firm.

. The

bigger the sum of the ex ante costs, the larger the range of leading-edge

innovations licensed by the efficient firm.

Proof. Firm

i bids for an

exclusive license to a leading-edge innovation ![]() in the

amount of

in the

amount of ![]() . From

this it follows that

. From

this it follows that ![]() if and

only if

if and

only if ![]() . Imposing

the restrictions

. Imposing

the restrictions ![]() and

and ![]() , and using the definition of ex ante cost asymmetry

, and using the definition of ex ante cost asymmetry ![]() leads to

Propositions 5 through 7. ■

leads to

Propositions 5 through 7. ■

The overall picture that emerges from these results is

that a sufficiently large ex ante cost gap will be widened by a leading-edge

innovation. However, if the initial

cost asymmetry is not too large and the leading-edge innovation is not too

significant, then the inefficient firm will license the innovation and leapfrog

the efficient firm. Such

leapfrogging is not possible when licensing a step-eliminating innovation,【332頁】 as the next

proposition shows.

Proposition 8. Any step-eliminating innovation ![]() is

licensed by the efficient firm.

is

licensed by the efficient firm.

Proof. Firm i

bids for an exclusive license to the step-eliminating innovation in the amount

of ![]() . From

this it follows that

. From

this it follows that ![]() , which implies firm 1 wins the auction. ■

, which implies firm 1 wins the auction. ■

In particular, if a step-eliminating innovation

satisfies ![]() , then potentially the inefficient firm could leapfrog

its competitor if only it could obtain the exclusive license. However, according to Proposition 8, the

efficient firm will outbid the inefficient firm in the auction and thereby

widen the cost asymmetry.

, then potentially the inefficient firm could leapfrog

its competitor if only it could obtain the exclusive license. However, according to Proposition 8, the

efficient firm will outbid the inefficient firm in the auction and thereby

widen the cost asymmetry.

5. Non-exclusive licensing of a new

production process via price-setting

Instead of holding an auction to allocate an exclusive

license, the inventor can set a price and offer a non-exclusive license to any

firm willing to pay the price. In

this section, we consider the allocation of licenses and inventor revenue under

such price-setting, and identify conditions under which the inventor prefers

price-setting to auctioning.

5.1 Licensing of a catch-up

innovation via price-setting

An inventor choosing how to sell license(s) to a

catch-up innovation would choose to hold an auction only for those innovations

that would be won and shelved by the efficient firm. If the auction would lead to licensing

by the inefficient firm, the inventor could earn more by non-exclusive

price-setting. The next proposition

makes this precise.

Proposition 9. If the inventor offers non-exclusive

licenses to a catch-up innovation, then (i) the efficient firm will not buy a

license at any positive price, and (ii) the inventor will earn higher licensing

fees than via exclusive auctioning if the innovation satisfies conditions in

Propositions 2 and 4 under which the inefficient firm wins the auction.

Proof.

(i) The efficient firm would not pay for a

non-exclusive license since the use value is zero and loss-prevention value

cannot be realized without exclusivity.

(ii) If an auction for an exclusive license is won by

the inefficient firm, then the firms’ bids must

have satisfied ![]() and the

license fee must be the smaller bid

and the

license fee must be the smaller bid ![]() . If

instead of holding an auction, the inventor were to set the price slightly

below

. If

instead of holding an auction, the inventor were to set the price slightly

below ![]() , then the inefficient firm would have bought the

license, since doing so would raise its profit. Since

, then the inefficient firm would have bought the

license, since doing so would raise its profit. Since ![]() , the inventor would have earned more revenue. ■

, the inventor would have earned more revenue. ■

Thus, it makes sense for the inventor to hold an

exclusive auction for a catch-up innovation only if the loss-prevention value

for the efficient firm exceeds the use value for the inefficient firm. Otherwise, 【333頁】price-setting is a more profitable way for

the inventor to sell the license to the inefficient firm. Even though price-setting potentially

makes the innovation available to both firms on a non-exclusive basis, in

effect the outcome is a single license to the efficient firm.

5.2 Licensing of a leading-edge

innovation via price-setting

If both firms obtain a license to a leading-edge

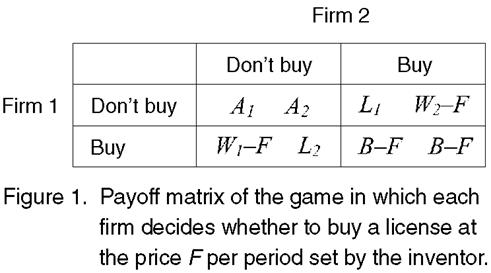

innovation, then each firm will earn a gross profit which we will denote by ![]() . Figure 1

shows the firms’ payoff matrix in the price-setting licensing

game in which the inventor first announces a license fee F per period and then each firm decides whether to buy a license or

not. As the following propositions

establish, there are two candidate prices that the inventor must choose from

when setting a non-exclusive license fee to a leading-edge innovation: either

. Figure 1

shows the firms’ payoff matrix in the price-setting licensing

game in which the inventor first announces a license fee F per period and then each firm decides whether to buy a license or

not. As the following propositions

establish, there are two candidate prices that the inventor must choose from

when setting a non-exclusive license fee to a leading-edge innovation: either ![]() or

or ![]() .

.

Lemma 1. For any leading-edge innovation ![]() and any

cost and demand parameters satisfying (1), Cournot profits gross of the license

fee satisfy all of the following inequalities:

and any

cost and demand parameters satisfying (1), Cournot profits gross of the license

fee satisfy all of the following inequalities:

(i) ![]()

(ii) ![]()

(iii) ![]()

(iv) ![]()

Proof. Inequalities (i), (ii) and (iii) follow

from the definitions of the Cournot profit functions. To prove (iv), we note that the equation

![]() reduces to

reduces to

![]() , which has no real roots in e. Thus

, which has no real roots in e. Thus ![]() as a

function of e is a parabola with no

zero-crossings. Therefore, for all e, either

as a

function of e is a parabola with no

zero-crossings. Therefore, for all e, either ![]() or

or ![]() . When e = c1,

. When e = c1, ![]() ; therefore this must hold for all e. ■

; therefore this must hold for all e. ■

Proposition 10.

The highest price an inventor can set such that both firms will buy a

license to a leading-edge innovation is ![]() . Both

firms will suffer a decrease in net profit as a result of buying a license at

this price.

. Both

firms will suffer a decrease in net profit as a result of buying a license at

this price.

【334頁】Proof.

From the payoff matrix in Figure 1, it can be seen that (Buy, Buy) is a

Nash equilibrium of the price-setting licensing game if and only if ![]() and

and ![]() .

According to Lemma 1(i),

.

According to Lemma 1(i), ![]() .

Therefore,

.

Therefore, ![]() is the

binding upper limit on the license fee. After the firms purchase licenses

at this price, each firm’s net profit

will be

is the

binding upper limit on the license fee. After the firms purchase licenses

at this price, each firm’s net profit

will be ![]() , which is less than A1 and A2 by Lemma

1(i). ■

, which is less than A1 and A2 by Lemma

1(i). ■

Proposition 11.

The highest price an inventor can set such that exactly one firm will

buy a license to a leading-edge innovation is ![]() . This

price will induce only the inefficient firm to become a licensee. The licensee’s net profit

will be the same as ex ante; non-licensee’s profit will

be lower than ex ante.

. This

price will induce only the inefficient firm to become a licensee. The licensee’s net profit

will be the same as ex ante; non-licensee’s profit will

be lower than ex ante.

Proof. From the payoff matrix in Figure 1, it

can be seen that (Don’t buy, Buy) is a Nash equilibrium of the

price-setting licensing game if and only if ![]() and

and ![]() . Such a

fee F exists by Lemma 1(iv). Next, we need to confirm that the

inventor cannot obtain a higher license fee in the (Buy, Don’t buy) equilibrium. (Buy, Don’t buy) is a

Nash equilibrium if and only if

. Such a

fee F exists by Lemma 1(iv). Next, we need to confirm that the

inventor cannot obtain a higher license fee in the (Buy, Don’t buy) equilibrium. (Buy, Don’t buy) is a

Nash equilibrium if and only if ![]() and

and ![]() .

According to Lemma 1(iii), the upper bound on F in this equilibrium is below that of the (Don’t buy, Buy) equilibrium. Finally, ex post profits in the (Don’t buy, Buy) equilibrium with the price

.

According to Lemma 1(iii), the upper bound on F in this equilibrium is below that of the (Don’t buy, Buy) equilibrium. Finally, ex post profits in the (Don’t buy, Buy) equilibrium with the price ![]() are

are ![]() for firm 1

and

for firm 1

and ![]() for firm

2. ■

for firm

2. ■

The next proposition identifies conditions under which

the inventor prefers to set the license fee aiming to license both firms, and

conditions under which the inventor prefers to set the fee so as to license

only the inefficient firm.

Proposition 12.

An inventor who uses price-setting to sell licenses to a leading-edge innovation

maximizes licensing revenue by setting the fee to ![]() , and thereby licensing both firms, if

, and thereby licensing both firms, if ![]() and

and ![]() .

Otherwise (i.e., if

.

Otherwise (i.e., if ![]() , or

, or ![]() and

and ![]() ), the inventor maximizes licensing revenue by setting

the fee to

), the inventor maximizes licensing revenue by setting

the fee to ![]() and

thereby licensing only the inefficient firm.

and

thereby licensing only the inefficient firm.

Proof. The inventor can set the price to

attract either one or both firms.

Propositions 10 and 11 establish the highest price possible for each

case. Inventor’s maximum revenue from licensing both firms is ![]() , which exceeds the maximum revenue from licensing one

firm

, which exceeds the maximum revenue from licensing one

firm ![]() iff

iff ![]() . This inequality

reduces to

. This inequality

reduces to ![]() . Applying

assumption (1) constrains e to the

range

. Applying

assumption (1) constrains e to the

range ![]() . ■

. ■

Finally, we consider conditions under which an

inventor of a leading-edge innovation earns more via exclusive auctioning than

via non-exclusive price-setting. As

the next proposition establishes, if price-setting results in licensing only a

single firm, the inventor can earn more revenue by instead holding an auction

for an exclusive license.

Proposition 13.

If licensing a leading-edge innovation via price-setting would result in

licensing only one firm, the inventor can earn more revenue by instead

auctioning off an exclusive license.

【335頁】

Proof. If ![]() or if

or if ![]() and

and ![]() , then, according to Proposition 12, the

profit-maximizing price is

, then, according to Proposition 12, the

profit-maximizing price is ![]() , only the inefficient firm buys, and the licensing

revenue is F2. An auction for an exclusive license

would yield

, only the inefficient firm buys, and the licensing

revenue is F2. An auction for an exclusive license

would yield ![]() in

licensing revenue, which exceeds F2 according to Lemma 1(i). ■

in

licensing revenue, which exceeds F2 according to Lemma 1(i). ■

As can be easily verified with a numerical

counter-example, the converse of Proposition 13 does not hold. Thus, in cases when price-setting would

result in both firms buying a license, the inventor may or may not find it more

profitable to instead auction off an exclusive license. Unlike in models with identical firms

licensing a step-eliminating innovation, the inventor in our model does not

necessarily earn more via exclusive-license auctioning than via non-exclusive

price-setting.

6. Conclusion

We began by inquiring into how the usual theoretical

definition of a cost-reducing innovation may be interpreted in the context of a

typical manufacturing industry, and whether there are other plausible kinds of

cost-reducing innovations. We have

outlined a brief typology of cost-reducing innovations that distinguishes

step-eliminating, new-process, and general cost-reducing innovations. We then focused on the licensing

of a new process innovation, keeping track of its two sub-types: leading-edge

and catch-up innovations. The

licensing equilibria that we have derived are substantively different from

those in previous studies focused on the case of symmetric firms licensing a

step-eliminating innovation. We

have shown that when firms with different ex ante costs engage in a game to

allocate a license to a new process via auction or price-setting, outcomes that

have been ruled out in many strategic licensing models become possible. In particular, the relatively inefficient

firm may catch-up to and even leapfrog its rival, price-setting without

quantity restrictions may yield higher licensing revenue to the inventor than

auctioning off a restricted number of licenses, and the licensee does not

necessarily end up with less net profit than ex ante.

References

Aseff, J., Chade H., 2008. An optimal auction with

identity-dependent externalities. RAND Journal of Economics 39:3, 731-746

Das Varma, G., 2002. Standard auctions with

identity-dependent externalities. RAND Journal of Economics 33:4, 689-708

Funk, P. 1996. Auctions with interdependent

valuations. International Journal of Game Theory 25, 51-64

Kamien, M., 1992. Patent Licensing. In: Aumann, R.,

Sergiu, H. (Eds.), Handbook of Game Theory with Economic Applications, Vol. 1,

Kamien, M., Tauman Y., 1984. The private value of a

patent: a game theoretic analysis. Journal of Economics (Suppl) 4, 93-118

Kamien, M., Tauman, Y., 1986. Fees versus royalties

and the private value of a patent. Quarterly Journal of Economics 101:3,

471-492

【336頁】Katz, M., Shapiro, C., 1986. How to license

intangible property. Quarterly Journal of Economics 101:3, 567-589

Sen, D., Tauman, Y., 2007. General licensing schemes

for a cost-reducing innovation. Games and Economic Behavior 59:1, 163-186

Shapiro, C., 1985. Patent licensing and R & D

rivalry. American Economic Review 75:2, 25-30

Wang, X., 1998. Fee versus royalty licensing in a

Cournot duopoly model. Economics Letters 60, 55-62